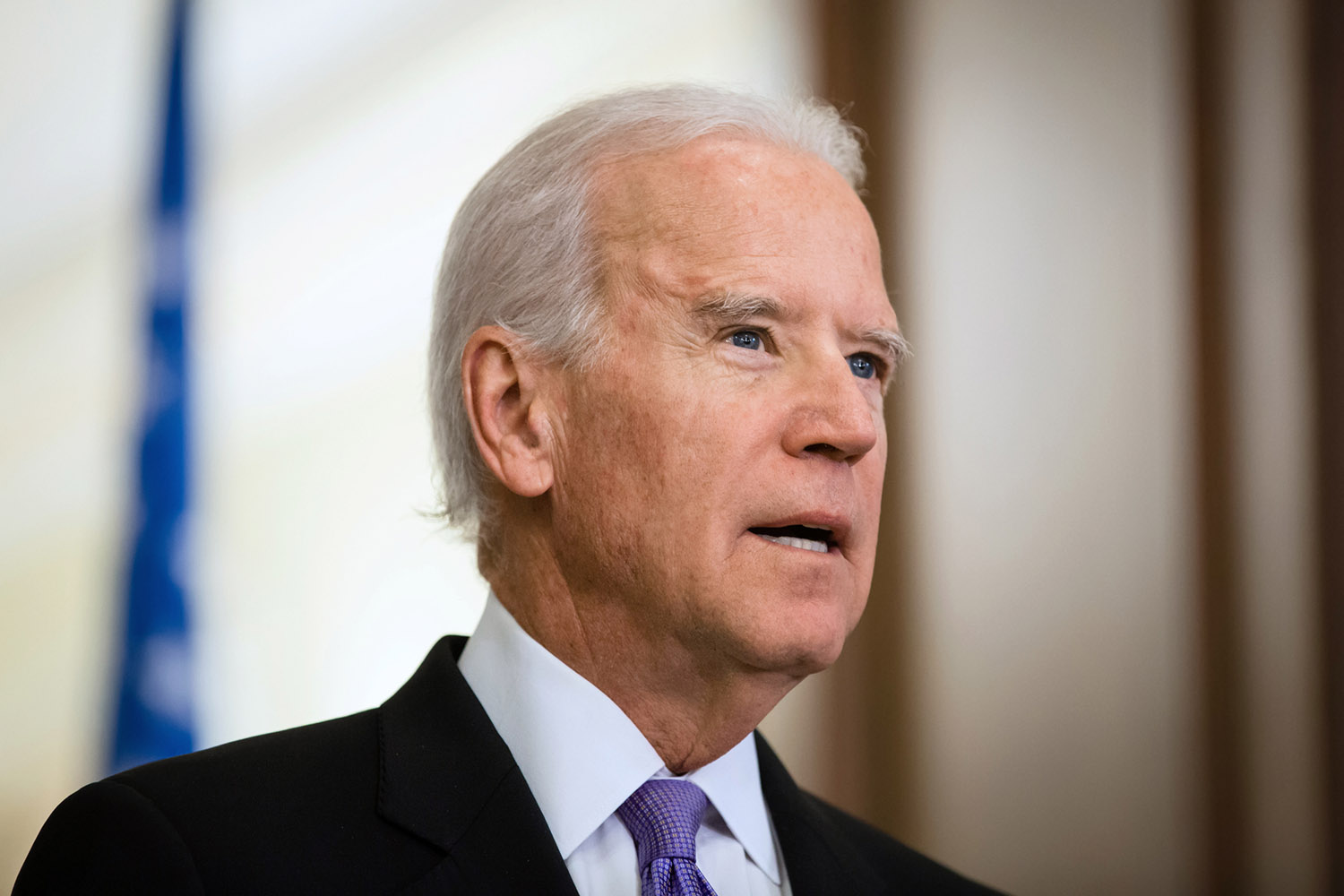

No matter your political affiliation, you may be wondering, “what does presumptive President-Elect Joe Biden have planned for the United States and its businesses when he takes office on January 20, 2021?” The below summarizes a couple of key points that Joe Biden has indicated will be priorities:

Pandemic

Biden has indicated a top focus will be getting COVID-19 under control. As part of that, a nationwide mask mandate is expected (although the legal authority for such a federal mandate is uncertain). He also will focus on boosting production of coronavirus testing kits and lab supplies, and making COVID-19 testing, treatment and vaccines free for all Americans. Biden is widely expected to be more active regarding the COVID-19 pandemic in general.

Economy

Biden is expected to introduce new legislation (subject to approval of congress), to undo many of the tax cuts in the 2018 Tax Cuts and Jobs Act. He also has indicated an intention to make significant changes to the tax code. These include:

For Individuals:

- The Social Security Tax (12.4%) on payroll would apply to income earned above $400,000. Wages between approximately $137,700 and $400,000 would not be subject to social security tax.

- The top individual income tax bracket would revert to 39.6% for incomes above $400,000.

- Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6 percent on income above $1 million and eliminates step-up in basis for capital gains taxation. This is expected to significantly impact the taxation of real estate sales and business sales.

- Caps itemized deductions at 28 percent of value for those earning more than $400,000. Taxpayers earning above that income threshold with tax rates higher than 28 percent would face limited itemized deductions.

- Phases out the qualified business income deduction (Section 199A) for filers with taxable income above $400,000 (regardless of type of business). Previously certain specified services businesses and those with few or no employees were limited, but not all businesses.

- Expands the Earned Income Tax Credit (EITC) for childless workers aged 65+; This provides renewable-energy-related tax credits to individuals.

- Increases the Child and Dependent Care Tax Credit (CDCTC) from a maximum of $3,000 in qualified expenses to $8,000 ($16,000 for multiple dependents) and increases the maximum reimbursement rate from 35 percent to 50 percent.

- For 2021(and potentially into the future) increases the Child Tax Credit (CTC) from a maximum value of $2,000 to $3,000 for children 17 or younger, while providing a $600 bonus credit for children under 6. The CTC would also be changed to be fully refundable.

- Reestablishes the First-Time Homebuyers’ Tax Credit, which will provide up to $15,000 for first-time homebuyers.

- Equalizing the tax benefits of traditional retirement accounts (such as 401(k)s and individual retirement accounts) by providing a refundable tax credit in place of traditional deductibility. It is currently unclear how this would impact individual taxable income.

- Removing certain real estate industry tax provisions (the provisions targeted are unclear at the represent time).

- Expanding the Affordable Care Act’s premium tax credit.

- Implementing a refundable renter’s tax credit capped at $5 billion per year, aimed at holding rent and utility payments at 30 percent of monthly income.

- Reduces the Estate and Gift Tax exemption thresholds to 2009 levels (3.5 million, with a top rate of 45% rather than the current rate). This threshold would be much closer to the Minnesota estate tax exemption of 3.0 Million. Texas has no comparable state estate tax or inheritance tax.

For Businesses

- Increase the Corporate Income Tax rate from 21% to 28%

- Creates a minimum tax on high earning corporations with $100 million or more book profits. The minimum tax will be structured as an alternative minimum tax, with the corporation paying a minimum of the greater of 15% (allowing for net operating losses and foreign tax credits) or the tax indicated on the usual tax return. a minimum tax on corporations with book profits of $100 million or higher.

- Doubles the tax rate on Global Intangible Low Tax Income (GILTI) earned by foreign subsidiaries of US firms from 10.5 percent to 21 percent. This would increase taxation of foreign sourced income of US Firms. Biden would also assess GILTI on a country-by-bounty basis and eliminate certain exemptions.

- Creates a Manufacturing Communities Tax Credit to reduce the tax liability of businesses that experience workforce layoffs or a major government institution closure

- Expands the New Markets Tax Credit and makes it permanent (this is a current credit that benefits certain disadvantaged economic areas of the USA).

- Create tax credits for small businesses that offer workplace retirement plans.

- Create a surtax on corporations that offshore manufacturing/services and creating credits for Made in America products.

All taxpayers should note that the majority of the above actions require a bill be passes by Congress to implement, leaving the breadth of provisions that will ultimately be implemented uncertain (with a divided Congress). Biden also has promised to increase enforcement of tax policies already on the books, and encourage the federal government to buy American (not foreign) goods.

Immigration

Biden has pledged to send an immigration bill containing a pathway to citizenship for the 11 million people living in the country illegally on day one of his presidency. Biden is also expected to reinstate the Deferred Action for Childhood Arrivals (DACA) program. Additionally, Biden has said he intends to halt deportations during his first 100 days in office. Biden would rescind Trump’s travel bans that restrict travelers from 13 primarily Muslim majority/African nations.

Environment

Biden is expected to set higher clean-energy targets, and ban coal and natural gas leasing on federal lands while curbing methane emissions from oil and gas production. He also intends to increase enforcement against polluters.

International Relations

Biden has indicted an intent to rejoin the World Health Organization and Paris climate accord. He will also re-enter the Iran nuclear deal. Biden would also seek to rebuild bridges with allies alienated during the Trump administration.

Civil Rights

Biden, within the first 100 days of his presidency, as pledged to work on getting the Equity Act passed, which is an anti-discrimination bill for sexual and gender identify.

A Few End of Year Reminders

The scope of what Biden ultimately implements of the above referenced items is uncertain as we close out 2020 (and indeed, will be so long into 2021). However, we leave you with a couple quick end of year reminders:

- The Biden tax plan will not impact 2020 taxes. The current provisions of the Tax Cuts and Jobs Act will govern 2020 taxes.

- If you took a Paycheck Protection Program (PPP) Loan and intend to apply for forgiveness, you should be aware that the forgiveness will limit your ability to deduct expenses paid for by the PPP Loan. This has the effect of increasing your total adjusted gross income by the amount of the PPP Loan forgiven. Have you planned for $150,000+ in additional income?

- Emergency Sick Leave and Emergency Family & Medical Leave (for COVID-19): As currently drafted these paid leave entitlements expire on December 31, 2020, although it is possible they may be extended.

- Major Transactions: Did you or your company have some major events or transactions happen this year? Have those all been documented by your legal counsel and accountant?

- Employee Bonuses: The holidays are a common time to give employees bonuses and additional compensation. These periods are also a good time to consider implementation of non-competes, non-solicitation, or non-disclosure agreements for employees, if you are looking at revising your agreements.

We wish your company and you all the best throughout the coming holiday season and new year.